Upcoming EU CSRD Directive: Preparing for the Future of Sustainability Reporting

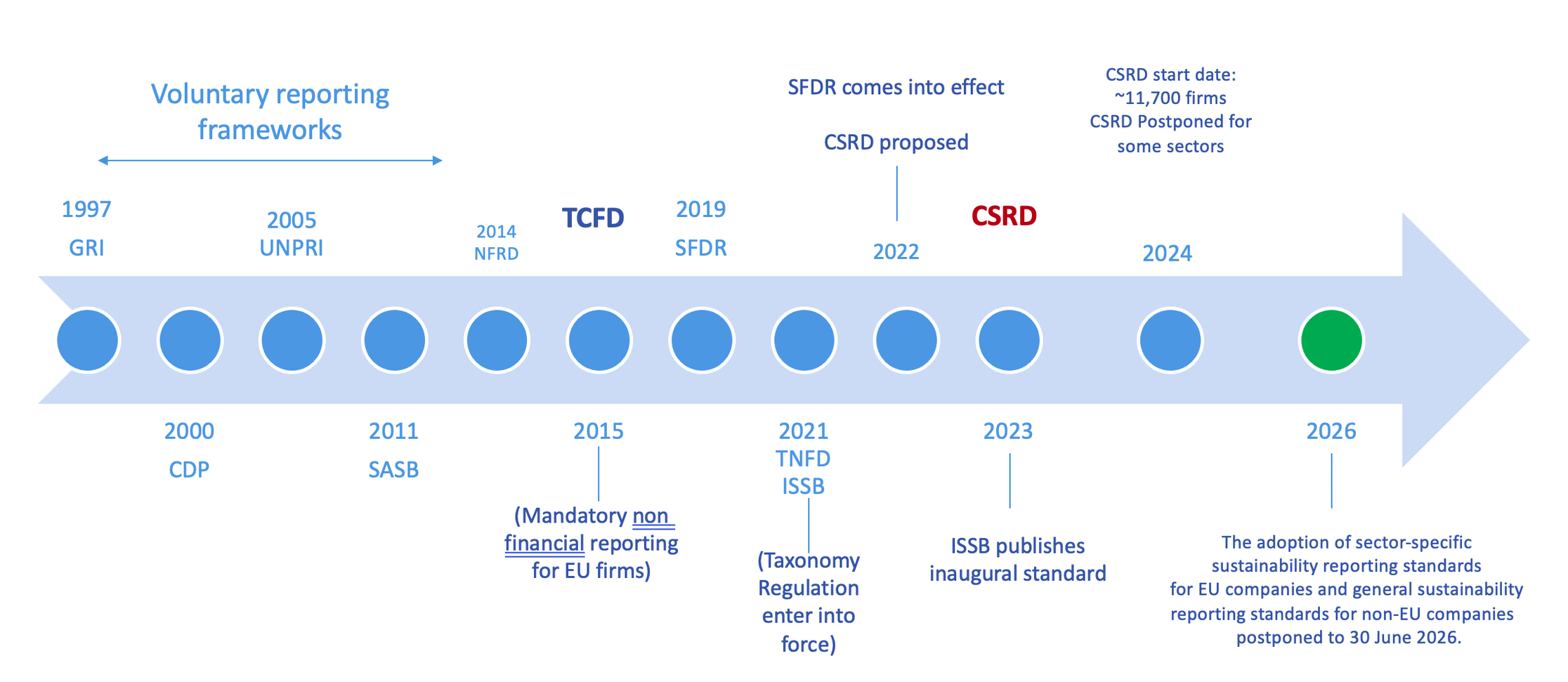

The European Union’s Corporate Sustainability Reporting Directive (CSRD) represents a monumental shift in corporate reporting, broadening the scope and depth of sustainability disclosures across industries. Officially enacted in January 2023, the directive is set to significantly impact firms within the EU and beyond, requiring them to rethink how they collect, manage, and report their environmental, social, and governance (ESG) data.

This article will explore the CSRD’s essential components, focusing on reporting requirements, compliance deadlines, and the concept of double materiality. It will also guide companies in navigating this complex new landscape.

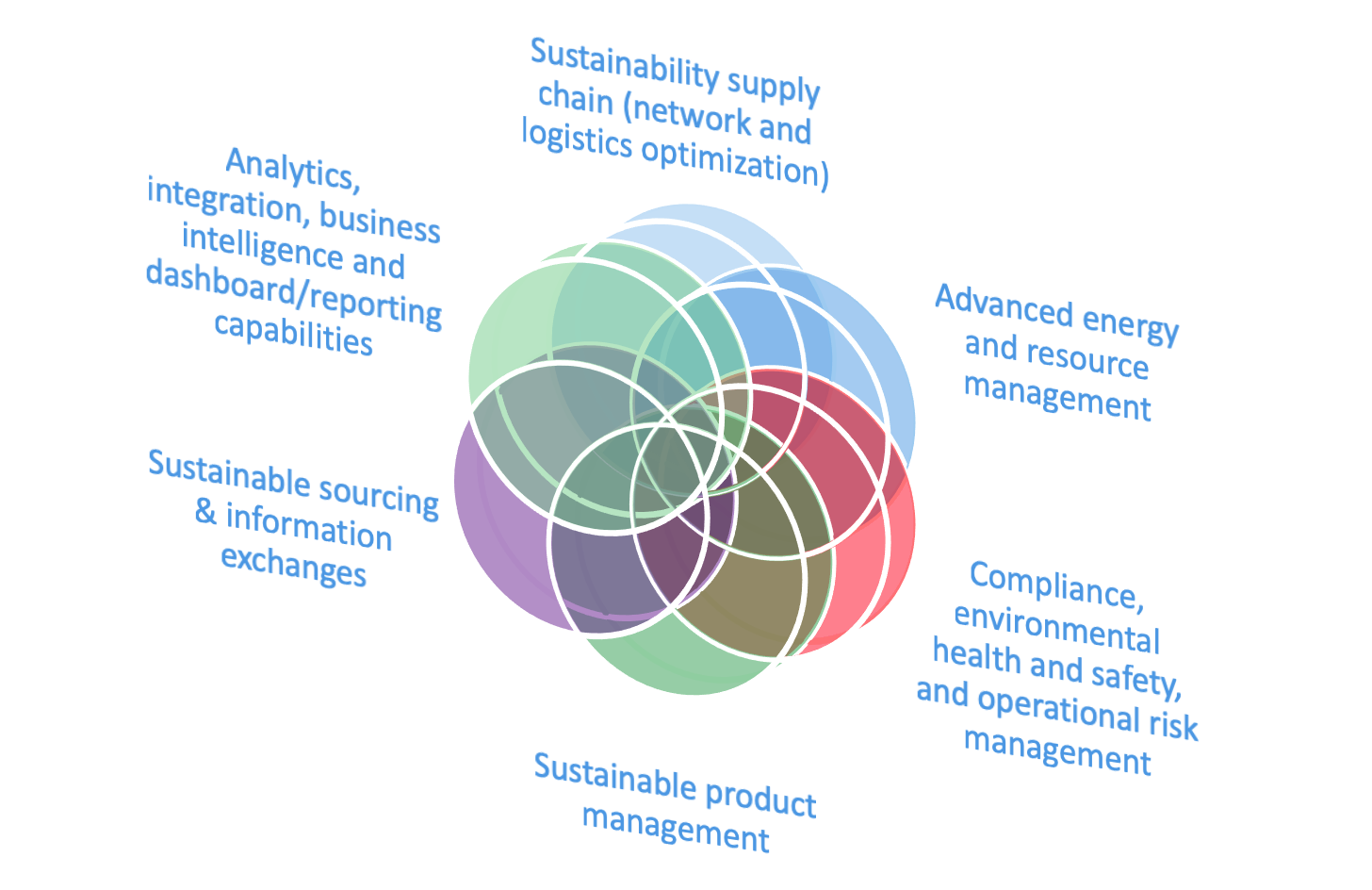

Single Platform, many interacting and unified apps.

1. Introduction to CSRD: Expanding ESG Reporting

The CSRD replaces the EU’s earlier Non-Financial Reporting Directive (NFRD), dramatically increasing the number of companies that must comply with sustainability reporting regulations. Under the NFRD, only about 11,700 firms were required to disclose sustainability data. With the CSRD in force, this number will grow to approximately 50,000 by 2028, including EU-based and non-EU firms operating within the European market or listed on EU stock exchanges.

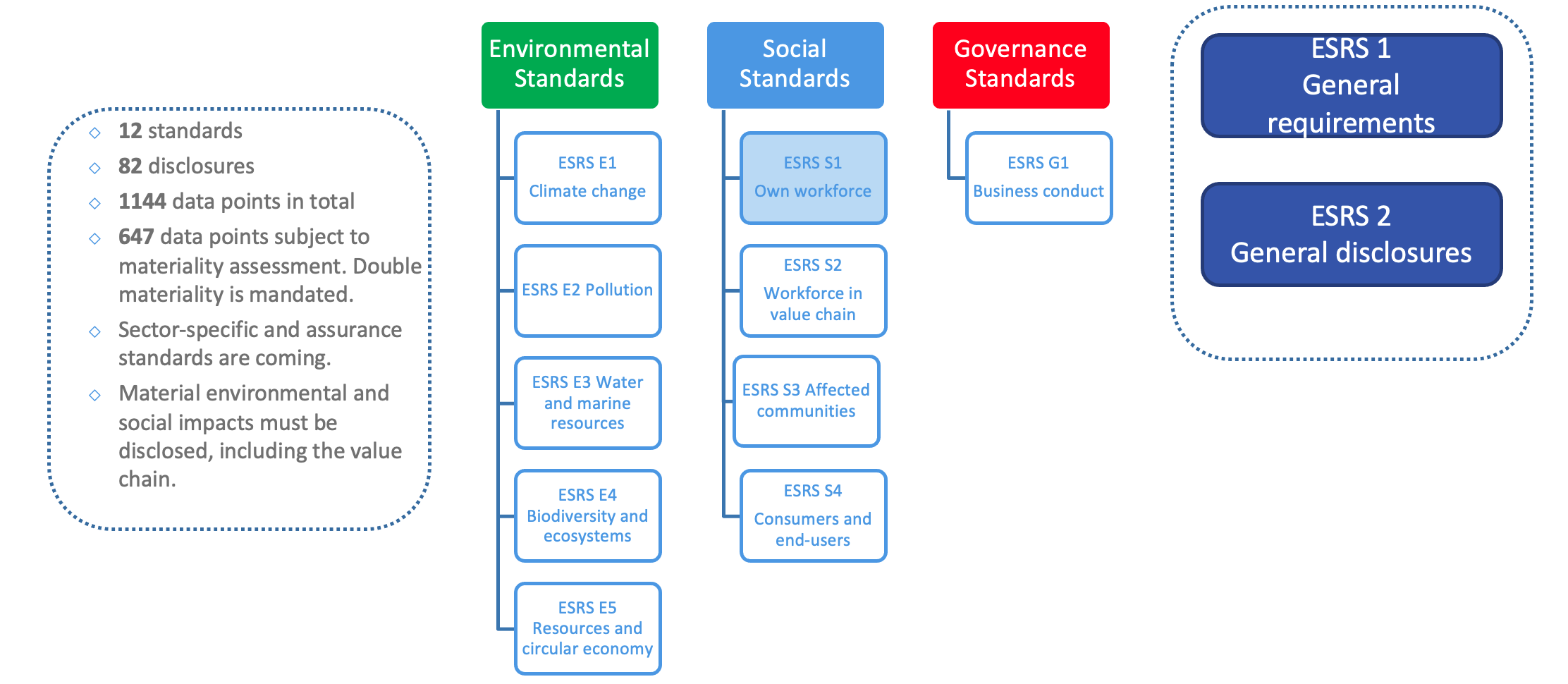

The CSRD’s primary goal is to enhance corporate transparency on sustainability issues, giving stakeholders—including investors, consumers, and regulators—a clear and consistent view of a company’s ESG performance. It requires companies to align their reporting with the European Sustainability Reporting Standards (ESRS), which outline the specific information to be disclosed across the environmental, social, and governance pillars.

The CSRD Heralds a new era for ESG and Sustainability Reporting.

2. Key Reporting Requirements Under CSRD

The CSRD mandates that companies provide backward-looking and forward-looking data on their sustainability strategies, performance, and risks. The reporting requirements are comprehensive, covering a wide range of ESG metrics. Some of the critical areas include:

- Environmental Metrics: Companies must report on their greenhouse gas emissions, energy usage, water consumption, and waste management practices. This requires transparency across the entire value chain, ensuring the data collected is consistent and reliable across various subsidiaries and locations.

- Social Metrics: Disclosures must cover employee welfare, diversity and inclusion, labor practices, and community engagement. Managing this data often involves extensive collaboration with internal and external stakeholders to ensure accuracy and completeness.

- Governance Metrics: Companies must provide information about their governance structures, including board composition, executive remuneration, and risk management practices. A strong emphasis is placed on ethical standards and adherence to regulations.

With over 1,100 data points identified within the ESRS, 176 are mandatory regardless of materiality. This illustrates the depth and complexity of the CSRD’s requirements, making early preparation crucial for compliance.

3. Double Materiality: The Cornerstone of CSRD

One of the most distinctive elements of the CSRD is the concept of double materiality, which goes beyond traditional financial materiality to include the company’s impact on society and the environment. This means companies must assess and report on two dimensions:

- Financial Materiality: How sustainability issues impact the company’s financial performance and position. This includes assessing risks like climate change, regulatory changes, and shifting consumer behaviors that could affect the bottom line.

- Impact Materiality: How the company’s operations impact the environment and society. This includes the company’s carbon footprint, waste generation, emissions, labor practices, and broader societal impacts.

Adopting double materiality reflects the growing recognition that a company’s value is determined by its financial performance and social and environmental footprint. Companies must now provide a balanced view of both their inward and outward impacts, which will be subject to third-party assurance.

4. Preparing for Compliance: Key Steps for Companies

Given the complexity of the CSRD, companies need to begin preparing as soon as possible. A successful compliance strategy should focus on several key areas:

- Data Collection and Management: Centralized, standardized, and auditable data collection systems are critical for complying with CSRD requirements. Companies must review their IT infrastructure and data collection processes to ensure they can handle the vast amounts of ESG data required. Automating data collection and using digital tools for real-time monitoring will help reduce the risk of errors and streamline reporting. One such tool is Locus Technologies Locus Platform and the CSRD app.

- Engaging Stakeholders: CSRD reporting is not siloed; it requires cross-functional collaboration. Engaging with various internal departments (such as finance, facilities management, risk management, and sustainability teams) as well as external stakeholders (suppliers, customers, and regulators) will be essential for gathering the necessary data and ensuring compliance.

- Assurance and Verification: Under the CSRD, sustainability data must be independently assured. Initially, this assurance will be limited, but over time, the requirements will shift toward a higher level of assurance. This means companies must ensure that their data is robust and that internal controls are in place to support third-party verification.

5. The Role of Technology: Supporting Digital Transformation

The role of technology as companies prepare for CSRD compliance cannot be overstated. Digital tools and software will ensure ESG data is accurate, traceable, and auditable. Data hubs, cloud-based reporting systems like Locus Platform, and automated data collection platforms will help companies streamline their processes and maintain a single source of truth for all ESG-related data.

Complex Interactions Among Apps for Sustainable Business and ESG Reporting.

CSRD requires digital tagging of sustainability data using the XBRL (eXtensible Business Reporting Language) taxonomy. This ensures that the data is machine-readable and comparable across companies and industries. Companies should consider integrating digital tagging into their reporting systems early to avoid delays and complications as reporting deadlines approach.

6. Looking Ahead: Strategic Benefits of CSRD Compliance

While compliance with the CSRD presents significant challenges, it also offers strategic opportunities for companies that embrace it effectively. By aligning sustainability reporting with the broader business strategy, companies can enhance their reputation, attract investment, and mitigate risks associated with ESG issues. Companies that adopt a proactive approach to CSRD compliance will likely gain a competitive edge as stakeholders increasingly demand transparency and accountability on sustainability matters.

Moreover, the CSRD encourages companies to integrate sustainability into their risk management frameworks and EHS compliance, helping them better identify and manage ESG risks. This ensures compliance and strengthens the company’s long-term resilience and adaptability in a rapidly changing business environment.

7. CSRD Reporting Deadlines

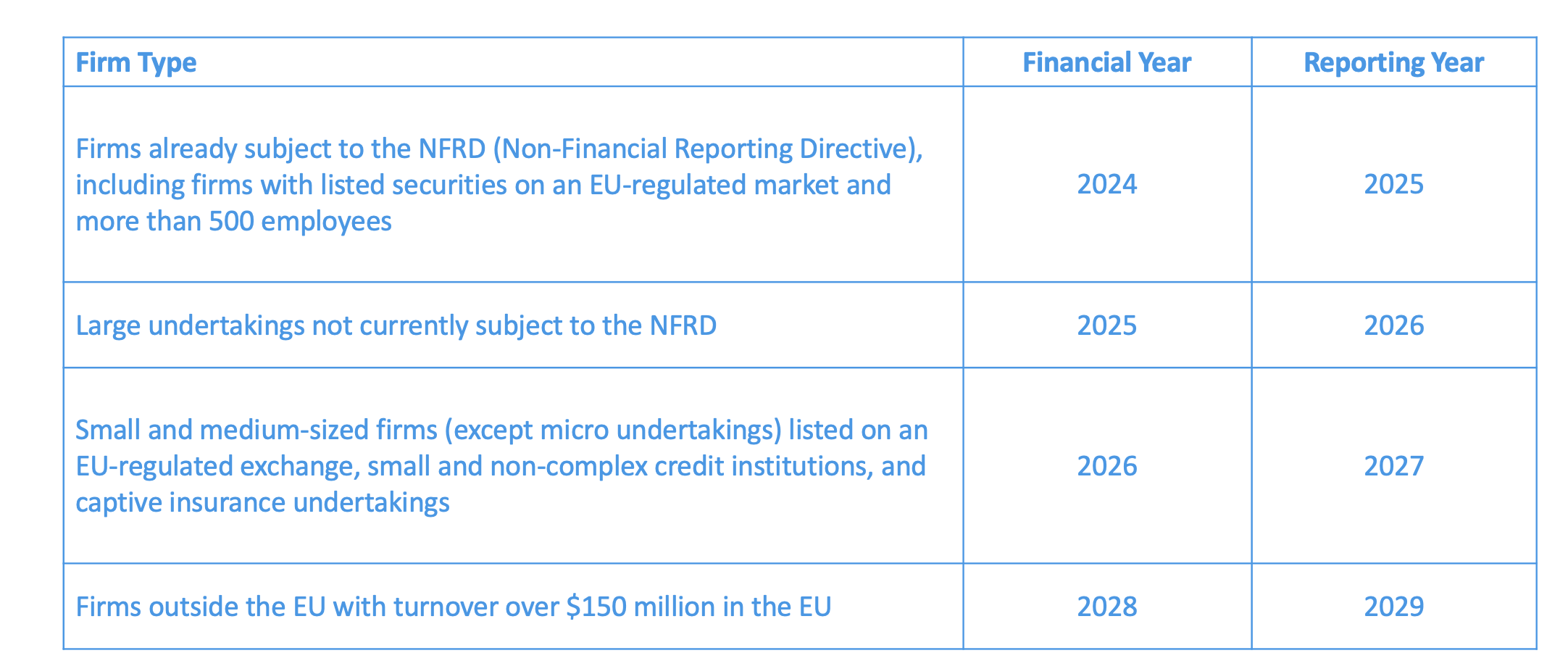

The CSRD) introduces a phased schedule for compliance starting in 2024. Large public-interest entities (with more than 500 employees) must report for the 2024 financial year, with their first report due in 2025. From 2025, large companies meeting at least two of the following criteria—over 250 employees, €40 million in turnover, or €20 million in total assets—must comply, reporting in 2026. SMEs and other listed companies will follow by 2027, with the possibility of voluntary opt-out until 2028. This directive significantly expands the scope of non-financial reporting, emphasizing environmental, social, and governance (ESG) disclosures aligned with the ESRS).

Timeline of Impact by Firm Type.

8. Taxonomy-aligned Sustainable Investments

In the context of the CSRD, TSI stands for Taxonomy-aligned Sustainable Investments. It refers to investments that align with the EU Taxonomy Regulation, a classification system developed by the European Union to define which economic activities are considered environmentally sustainable.

Under CSRD, companies must disclose how their activities, financial flows, and investments align with the EU Taxonomy. This is a critical aspect of CSRD reporting, as it helps investors and stakeholders evaluate how much a company’s operations contribute to the EU’s environmental objectives, such as climate change mitigation, sustainable use of resources, or pollution prevention. TSI disclosures are essential because they provide transparency on the sustainability of a company’s investments, directly impacting its ESG performance and ability to attract green financing or investment. As part of CSRD compliance, businesses must calculate and report the proportion of their revenues, capital expenditures, and operational expenditures that are taxonomy-aligned. Therefore, TSI is key in ensuring that organizations report consistent, comparable, and reliable sustainability data, especially related to their contributions to the EU’s environmental goals.

9. DG Reform: Ask for help

DG reform refers to the Directorate-General for Structural Reform Support, a body of The European Commission assists EU Member States in designing and implementing structural reforms to strengthen their administrative capacity and governance. This department offers technical support and advice on economic recovery, resilience, and sustainable growth reforms. DG reform is crucial in implementing EU policies, including public administration, financial governance, and sustainability reforms like the CSRD.

Article 15, within the context of the CSRD, refers explicitly to provisions for technical support from the Technical Support Instrument (TSI) provided by DG reform. Article 15 allows the European Commission to provide Member States with technical support in implementing the CSRD and associated reforms. This support includes guidance on building the necessary frameworks, governance mechanisms, and systems to meet CSRD requirements. The TSI can help governments with expertise and capacity-building to comply with CSRD’s reporting standards, improving transparency and governance around sustainability. This collaboration can involve capacity-building programs, advice on reporting frameworks and integrating EU Taxonomy standards into national regulatory systems.

10. Locus Strategic Advantage in the EU Markets

Locus Technologies is uniquely positioned to lead in the European CSRD reporting market. Our solutions align ideally with the EU’s stringent sustainability initiatives and regulations, offering a competitive advantage to organizations looking to navigate this regulatory environment. Locus’s deep understanding of European environmental policies, combined with our innovative software that handles the heavy lifting of complex data, ensures that our customers stay ahead of compliance deadlines while driving positive environmental and social impacts.

In addition, Locus has a strong track record of working with major corporations and public entities across Europe, providing us with unparalleled insights into local regulations and reporting challenges. Our cloud-based technology allows for easy scalability, making it an ideal fit for multinational corporations operating across the EU and beyond. Locus is also a leading verifier for the California Air Resources Board (CARB), embedding all best practices from that program—including full financial-grade audibility—into its software. This ensures that our clients benefit from the most stringent verification processes, which enhances transparency, accuracy, and compliance across sustainability reporting platforms. These capabilities make Locus a trusted partner for companies looking to meet evolving regulatory and sustainability requirements globally, all from a single software platform for worldwide reporting.

The CSRD establishes the European Sustainability Reporting Standard (ESRS) Reporting Framework.

Conclusion

The EU’s Corporate Sustainability Reporting Directive is set to reshape the corporate landscape by mandating more profound and comprehensive sustainability disclosures. With its focus on double materiality and stringent reporting standards, the CSRD represents both a challenge and an opportunity for businesses. Companies can turn compliance into a strategic advantage and lead the way in sustainable business practices by preparing early, leveraging technology, and engaging stakeholders across the value chain.

As deadlines loom, now is the time to act, ensuring that your organization is ready to meet the evolving expectations of stakeholders and regulators alike.